Thought Leadership

Sponsored by Fitch Ratings

US Auto Asset Quality: 2018 Review and 2019 Outlook

2018 Review

The credit performance of U.S. auto loans strengthened in 2018 with net charge-offs for the largest auto lenders declining on a year-over-year basis in 4Q18, according to the latest U.S. Auto Asset Quality Review report from Fitch Ratings. Delinquency trends were more mixed among auto lenders in 4Q18 but also declined on a year-over-year basis. Fitch believes the favorable credit performance in 2018 largely reflected a stronger U.S. economic backdrop but Fitch expects weaker trends to emerge this year, including downward pressure on used vehicle prices, which have already regressed through the first couple of months of 2019.

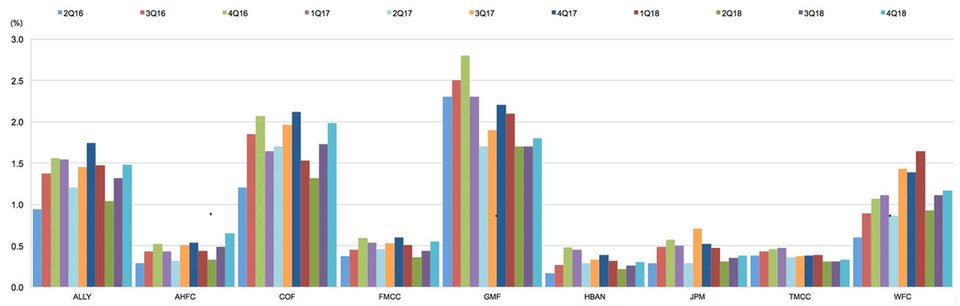

Managed Credit Losses

aNet chargeoff (NCO) rate is calculated by annualizing quarterly NCOs and dividing by average loan and lease receivables. bIncludes motorcycle portfolio. cNorth American portfolio through 1Q17, worldwide portfolio subsequently. dIndirect portfolio only.

The credit performance of prime and subprime lenders diverged further over the second half of 2018. Fitch's prime auto loan ABS 60+ day delinquency index was down 7 bps year-over-year to 0.32% in 4Q18, and was up slightly from 0.30% in 2Q18, which was the lowest level since 2014. Prime delinquencies continue to benefit from a strong macroeconomic backdrop in the U.S. with historically low unemployment levels. Conversely, subprime delinquencies (60+ days) increased in 4Q18, according to Fitch's ABS index, rising to 5.50% at the end of 4Q18 from 5.11% at the end of 4Q17.

According to the U.S. Federal Reserve's January 2019 senior loan officer survey, the degree of tightening of auto loan terms moderated from peak 2017 levels, when several large banks publicly indicated they had tightened auto loan standards. Loan terms continued to lengthen, particularly for nonprime borrowers, which could hurt recovery values longer term. Aggregate year-over-year auto portfolio (retail loan and lease) growth for lenders included in Fitch's report slowed to 2.8% in 2018, down from 5.6% in 2017.

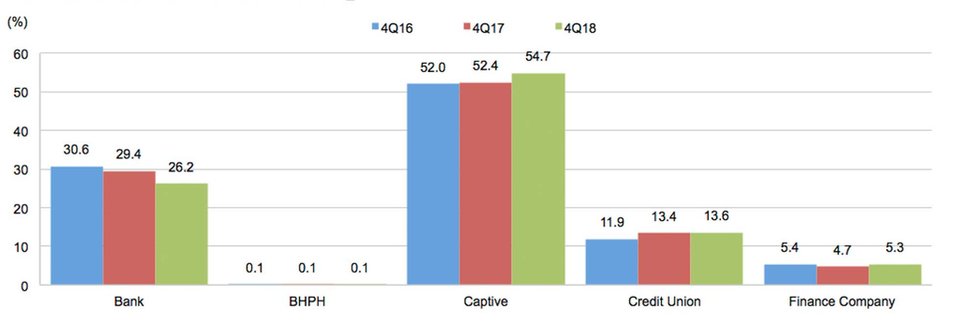

In recent quarters, loan growth has been greater for non-banks than banks. "As bank underwriting standards tightened for auto loans over the past couple of years, it appears the banks ceded market share to nonbank lenders, particularly captive finance firms and credit unions," said Michael Taiano, Senior Director, Fitch Ratings.

Market Share of New Vehicle Financing

Source: Experian-Oliver Wyman Market Intelligence reports.

2019 Outlook

Although slightly off of peak levels, solid auto demand has resulted in expanding loan portfolios across all lender groups, including banks, credit unions, captive finance companies and specialty lenders, although it appears that banks have ceded some market share to the other players after having tightened underwriting standards beginning in 2017.

In the U.S., certain auto lenders tightened their underwriting standards over the past couple of years in response to heightened competitive conditions and weaker credit performance stemming primarily from the 2015 and 2016 vintages. Despite stable to improving credit performance and solid loan growth, it is difficult to isolate the impact of the stimulus provided by the federal tax cuts and broader economic strength in the U.S. over the past year and, therefore, determine to what extent it can be sustained beyond 2018.

Fitch anticipates that U.S. auto finance and leasing companies’ earnings will be pressured over the near to medium term as U.S. new vehicle sales moderate from near peak levels, while higher interest rates and lower residuals on leases drive borrowers’ monthly payments higher, pressuring debt to income ratios. Fitch expects lower U.S. new vehicle sales of 16.9 million in 2019, returning to a flatter market with sales in the mid-16,000,000 to low-17,000,000 range for an extended period, similar to the pace experienced in the late 1990s through mid-2000s.

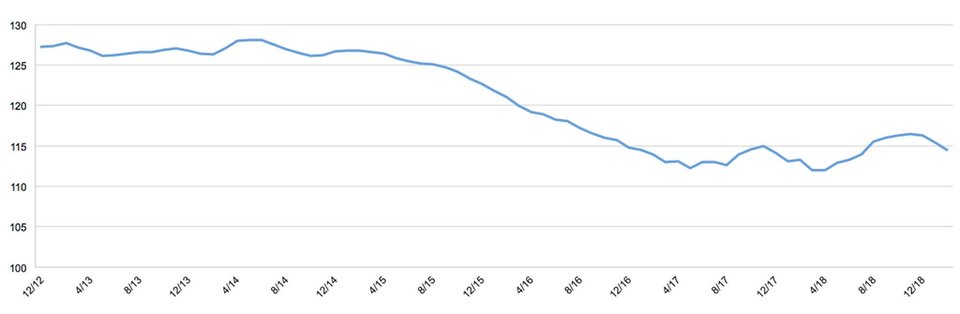

Black Book Used Vehicle Retention Index

Source: Black Book.

As for used car values, although used car prices performed better than expected through much of 2018, Fitch expects downward pressure to resume in 2019 as off-lease supply remains elevated, particularly should new car incentives increase again after having moderated more recently. Fitch maintains a Negative subsector outlook for the auto finance industry.

While the relative strength of key macroeconomic indicators will be a primary driver of loan growth and credit performance for the auto finance sector in 2019, Fitch believes the competitive environment will intensify with certain banks resuming growth and credit unions continuing to gain market share. That said, a pause by the Fed in raising interest rates should ease pressure on lenders’ net interest margins to varying degrees, as auto loans are largely fixed rate, depending on the issuer’s funding mix.

Fitch Ratings