THOUGHT LEADERSHIP

Sponsored by Close Brothers Asset Finance

Missed opportunities and credit cards – what today’s SMEs are talking about…

Missing business opportunities because of a lack of available finance is causing considerable pain for thousands of SMEs across the UK – and this despite the wide variety of funding sources available today. We know this because for well over a decade Close Brothers Asset Finance has commissioned research – conducted by a specialist, independent firm – polling around 4,000 SMEs annually on a wide range of subjects. In this piece I analyse the responses to some of the questions, picking out – where relevant - key statistics relevant to the sectors we specialise in.

By Neil Davies

Where SMEs go for financial support and advice…

Accountants remain the most popular source of financial advice, with 30% of those polled selecting this option, followed by their Finance Advisor (21%) and Bank Manager (17%). At the bottom of the list are ‘peers’ (3%) and ‘lawyers/solicitors’ (4%).

This result has remained steady for the last few years and it comes as no surprise, but what it does make clear is the diminishing role the bank manager is playing in business owners’ financial decisions. This is not a new trend – the data from the previous years clearly indicate that he bank is somewhere SMEs go to ask for money and not advice.

Funding availability

Funding options for SMEs have never been greater, yet for nearly a third (31%) of firms, accessing finance is a ‘major challenge’ and more difficult than it was a year ago; for a further 35% it’s no easier today than it was a year ago.

Only 12% feel it’s becoming easier with 23% saying it’s never been a problem to source funding.

Transport and Haulage firms are – by some distance - finding access to funding the most challenging. The truth is, unfortunately, many funders simply aren’t prepared to back SMEs in a sector where the perception is that low margins are the norm and firms are struggling to meet their emissions commitments.

Future plans

Despite the uncertainty brought about by the Brexit impasse, three out every five SMEs plan to seek funding for investment in the coming year.

This speaks volumes about the resilience of the UK’s businesses, many of whom are undeterred by the current economic and political outlook, most notably in the Manufacturing and Engineering sectors, where 74% are poised to invest

Options beyond traditional banking

Awareness of Asset Finance as a funding alternative to traditional banking is slowly increasing, with 48% of those polled aware of the option.

Unsurprisingly, knowledge is lowest among firms with 10 employees or fewer - the larger the organisation, the more likely it is that they will know about asset finance.

From a sector perspective, it’s highest among Engineering firms

Funding preferences

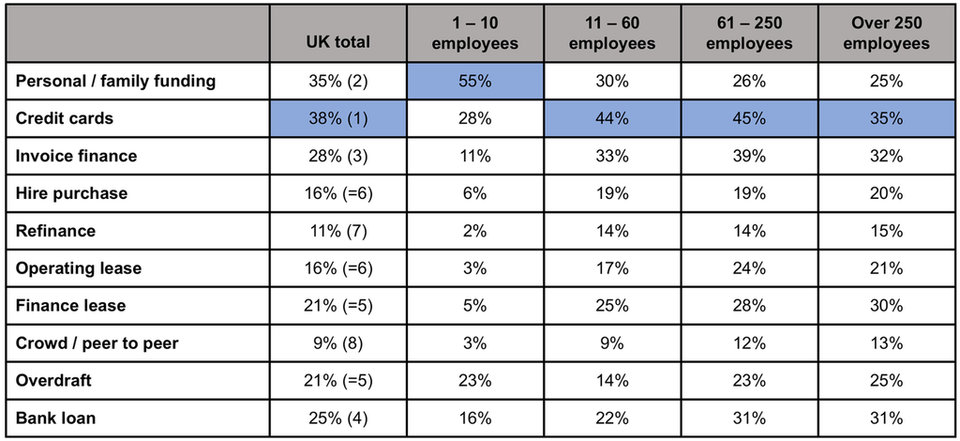

The continued use of credit cards and personal finance – particularly among the smaller firms - is not a surprise – it’s been the case for as long as we have been running the barometer. What is unusual is the prevalence of this type of funding for the larger firms – even those employing over 250 people.

What type of funding do you usually use for your business? (tick those that apply)

Missed business opportunities

Despite widely available low margin finance, four in every 10 firms admit to having missed a business opportunity in the last 12 months due to lack of available finance.

This figure jumps to 68% in London and goes some way to explaining why 64% of those polled in the Capital use their credit cards to fund their business.

Business performance expectations

Over a third (36%) of SMEs expect their business to expand, while 54% anticipate things to ‘stay the same’; only one in 10 will contract or close down.

These results are testament to firms’ resilience, with many business owners having witnessed and experienced multiple economic cycles – they know what needs to be done to keep trading.

Business concerns

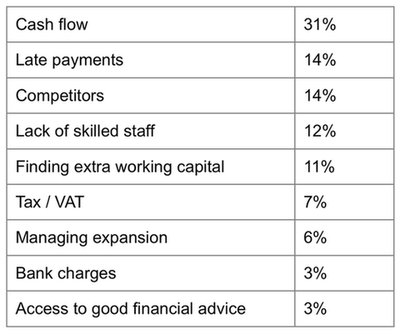

Cashflow is – by some distance – SMEs’ primary business concern, well ahead of competitive pressure and late payments.

There is much work that could be done by the finance industry to educate business owners about alternative funding options that would allow them to protect their cashflow – it doesn’t need to be the concern it clearly is for business owners.

To learn more about Close Brothers, visit closeasset.co.uk