THOUGHT LEADERSHIP

Sponsored by BNP Paribas Leasing Solutions

BNP Paribas Leasing Solutions at the heart of the real economy

For the past 70 years, the multi-channel approach of BNP Paribas Leasing Solutions has placed it at the heart of the real economy, where it supports the different actors that make it up – the professional clients of the BNP Paribas banking network, manufacturers, distributors and corporate clients looking to grow their sales or finance an equipment. So, when the COVID-19 crisis hit these stakeholders and the economy at large, it called for an immediate action plan to support these businesses that found themselves in an unprecedented situation.

State of the markets

Before initiating any action plan, it was important to understand that the impact of the health crisis and the sudden halt of the economic activity due to the lockdowns, didn’t impact all sectors in a homogenous manner. For example, essential activities like agriculture resisted well to the consequences of the health crisis, because no matter what the situation is, countries around the world will always have to feed their populations. The IT equipment market was also one of the few sectors that was able to maintain their business inflow, particularly because of the accelerated pace at which companies had to implement work from home, to ensure the safety of their employees.

On the other hand, there were industries that saw a sharp decline in their activity due to the lockdowns, like transport (except for those in the food industry) and construction where economic activity fell by almost 50% in April. It was the same case for other non-food-related businesses like textiles and automobiles industries which suffered quite a lot.

A strong, long-term collaboration that bore its fruits

During the crisis, BNP Paribas Leasing Solutions was able to rely on the strong and long-lasting relationships built with its partners over the years, with some going up to 30 years! The company has 50 international partnerships, representing around 400 local agreements from all sectors – agriculture, transport, construction, IT, office equipment, to name a few. This broad network, coupled with the other channels that the company operates within, helped finance 346, 000 projects in 2019 for a total of 14.1 billion euros in 20 different countries.

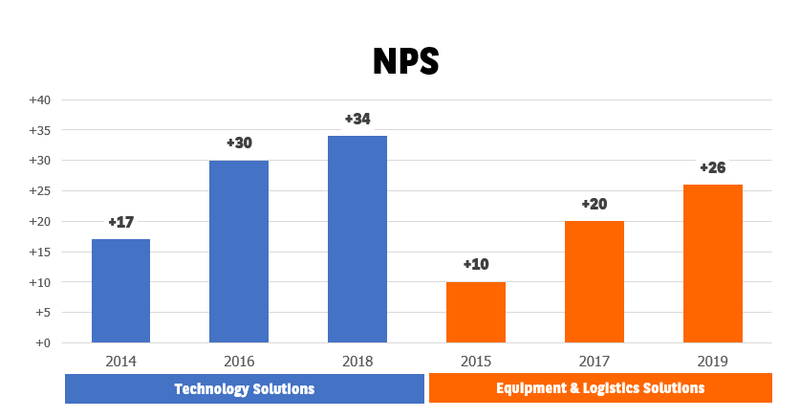

These partnerships have stood the test of time thanks to the specific initiatives launched to constantly evaluate the level of satisfaction of the partners and their changing needs, like conducting a quantitative survey every year and a qualitative survey every two years. The combination of these two approaches enables the company to consistently improve their service offer so that it aligns with the partners’ priorities.

The results from these two surveys help establish a Net Promoter Score, which indicates the likelihood of a partner recommending the solutions and services to another colleague or a peer. The steady increase in this score only goes on to further illustrate the strength of these partnerships.

Specific response to the COVID-19 crisis

George Ormsby, Head of SME, First Citizen Finance

Even during the most acute phase of the health crisis, the 3,600 employees around the world remained committed to ensure that the businesses get the support they need to stay afloat or to simply help manage the cash crunch from the sudden drop in business. The conventional approaches had to be adapted to the new context and any solution offered had to take into account the individual circumstances of each client. Despite the individual specificities and the uncertainty caused by the pandemic with the situation evolving every single day, one thing remained crystal clear and helped guide the actions that were launched – the need to be by the clients’ and partners’ side, in whichever way possible.

The response plan therefore involved, but wasn’t limited to:

- Finding new ways to keep in touch. With inperson meetings no longer possible because of the lockdowns, the interactions were moved online to not only maintain a strong rapport but also to work closely with the client or partner to support new projects or tweak existing contracts.

- Keeping the stakeholders informed. Newsletters were sent out regularly to our partners and clients to keep them up to date with the changing situation, our specific action plan for business continuity Launching new digital tools and reminding them of the existing ones so that they can continue doing many tasks remotely such as send a finance request, follow its status and even sign the contract electronically in some countries.

- Payment deferrals. More than 160,000 requests for deferring rental payments were treated during this period, a third of which came from the clients of the banking network of BNP Paribas.

- Implementation of exceptional processes. To manage the high volume of incoming payment deferral requests, specific measures were launched internally like deploying 15 robots to enable automatic treatment of up to 5,000 requests a day, and shuffling teams so that those with a reduced workload because of the crisis could lend a hand to those whose workload had suddenly gone up.

As countries slowly exit the lockdowns, the focus is now on economic recovery, even though the local challenges specific to each country and each sector continue to persist.

Nevertheless, the collaboration and the solidarity of these relationships with clients and partners came through during the crisis and will only go on to strengthen these already-solid ties

To learn more about BNP Paribas Leasing Solutions, visit www.group.bnpparibas

Email Address: robert.murray@firstcitizen.ie

Telephone Number: +353 (0)1 884 6743