Data Mining

Trends, challenges and opportunities in a new age of leasing

Asset finance has long offered a more flexible alternative to upfront, outright purchases, but increasingly, traditional leasing models struggle to accommodate the latest trends. Here, Jeffrey Andrews, senior sales consultant, asset finance at FIS, and Simon Harris, founder of the Motion Advisory, identify three key trends for auto and asset finance providers.

Three major developments, in particular, are disrupting the status quo for the auto and equipment finance industry and driving finance providers toward new ways of funding, thinking and working. While these trends affect many, if not all, industries to some extent, they have especially big implications for lessors and original equipment manufacturers (OEMs). And as both challenges and opportunities, one trend very much leads into another.

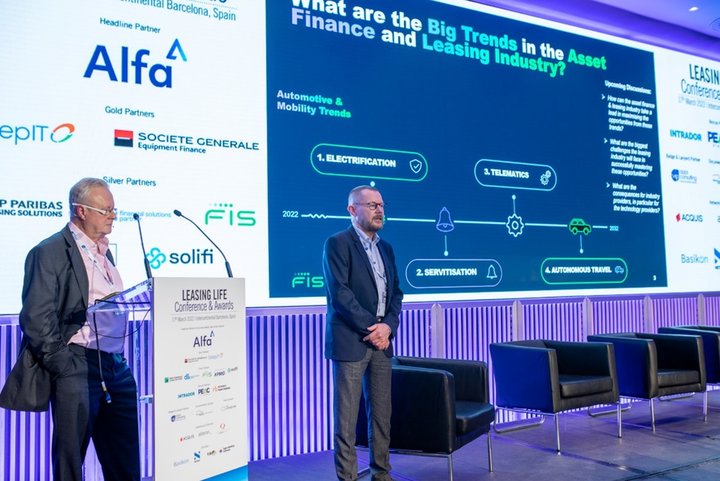

Jeff Andrews of FIS (left) and Simon Harris (Motion Advisory) during their presentation at the Leasing Life Conference in Barcelona in March 2022

ESG

Environmental, social and corporate governance (ESG) is already a well-known and well-used term in the world of business – and for many good reasons. As climate change continues to take its toll on the planet and scrutiny increases on corporate values and company structures, there’s more pressure than ever for firms to demonstrate sustainable, fair-minded and transparent practices.

For the asset finance and leasing industry, the ESG challenge is effectively doubled. Not only do finance providers need to fund more sustainable or reusable assets with as long a life cycle as possible, but their customers also have their own ESG requirements and objectives.

On two counts, then, there’s no escaping ESG. Plus, in many countries, government initiatives are now handing out tax penalties for assets that don’t meet strict criteria.

Striking a balance

With so much at stake for the environment, societies and economies, the asset finance industry as a whole is clearly on board with ESG principles and firms are actively looking for ways to burnish their credentials.

However, the journey toward sustainability is only just beginning for most organizations as they acclimatize to the idea, determine their objectives and work out how to achieve them.

Clearly, things are a little more straightforward for auto finance firms, as legislation drives them toward electric vehicles and, with coming bans around the world on petrol and diesel engines, gives them hard and fast milestones to reach.

For equipment lessors, the targets are more nebulous. The key will be for firms to balance their own ESG requirements with those of not only their customers but also of their OEM suppliers and partners, who must also think hard about how to reduce the carbon footprint of their products and improve their social responsibility.

Arguably, though, none of these three parties may be as eager to focus on the corporate governance aspect of asset finance contracts or encourage too much scrutiny of pricing processes. All of which segues neatly into the second trend on the list…

Servitisation

Servitisation is another term for what consumers call subscription and businesses – including asset finance firms and customers – call pay-per-use. Rather than purchasing and taking full ownership, servitisation lets you pay to use (or rent) items as and when you need them. The less or more you use, the less or more you pay.

How you measure usage varies from asset to asset. It could be by kilometre, per minute, per ton, per item produced and so on. Either way, it makes for a responsible, ESG-friendly form of financing and using equipment – one, in fact, that Xerox has been offering for years, by allowing customers to pay per sheet of paper when they lease photocopiers.

So, there’s nothing new about pay-per-use in asset finance; it’s just that most asset classes have yet to catch up with the Xerox model.

Although leasing was always ostensibly about usage over ownership – and was actually invented specifically for business users, over 50 years ago – finance providers have continued to base their pricing of assets on the cost of outright ownership. Traditionally, they’ve simply divided the full retail value of the asset into instalments – and have chosen, as the saying goes, to “fund and forget.”

The move from ownership to utilisation makes the math more complex and so introduces enormous challenges for asset finance pricing processes and their governance. When no one customer pays for an asset in its entirety, it’s much harder to relate payments to the value of the equipment.

What’s more, it then falls completely to the financier to find multiple customers and ensure multiple life cycles and contracts for the assets they own. Rather than focusing solely on credit risk, lessors must now assess and evaluate utilisation risk, too.

The challenge, then, will be to find enough customers to use an asset over its lifetime and generate enough revenue to pay for its total cost. You can no longer fund and forget; to maximise value, you need to keep ensuring maximum usage. Ultimately, that means a massive change of mindset for the asset finance industry.

As a classic example of funding and forgetting, the personal contract purchase (PCP) loans that have long underpinned auto finance show the distance most firms need to travel to support a pay-per-use economy. With PCP, a single customer ends up paying 100% of the cost of a car but could drive it as little as 6% of the time on average. In simplistic terms, offering the same car on a pay-per-use basis theoretically leaves 94% of its life cycle to be made available to another 15 customers.

Moving to service aggregation

The other problem with generating pay-per-use revenue is that finance margins can only go so far. There’s a limit to how much customers – especially corporate customers – will pay for asset finance, and so the only way to grow profits through servitisation is to offer additional services to support the asset and optimise usage.

In the aviation sector, this kind of service aggregation has long been a key part of asset finance arrangements. Rather than own their planes, most airlines lease them and pay for a large package of services on the side, with OEMs typically taking care of maintenance on an ongoing basis and keeping aircraft safe.

In a pay-per-use world, this model will need to be extended to the whole auto and equipment finance industry. In auto finance, for example, the financier could become the aggregator of a full range of services that keeps cars on the road, including taking care of servicing and repairs, annual taxation, insurance, tire changes, wear and tear, etc. As the owner of thousands of assets, firms can source and provide these services more efficiently and cost-effectively than individual users, while still maintaining a margin.

If an attractive bundle of services is one way to reduce utilisation risk, then another is gathering data on utilisation. And in today’s increasingly connected world, where all manner of vehicles, equipment, devices and appliances can link up and share data with the internet of things, utilisation data is not in short supply.

The question is: who gets that data? While GDPR regulation limits access to data on privately leased vehicles, there are far fewer restrictions on the monitoring and analysis of commercially leased equipment. As asset owners, finance providers are actually entitled to certain data, although historically OEMs have often kept it for themselves.

Mining data for intelligence

The rise of servitisation models now makes it more critical for asset owners to take possession of utilisation data.

If financiers can see where, when or how much equipment is being used, or whether issues arise from that usage, they are in a stronger position to optimize pricing. That could mean building in margins to account for services or allowing for replacements when assets are out of operation.

Data is the new gold – and data on usage can spell the difference between profit and loss on a deal. That’s why so many asset finance firms are now investing in data scientists, who can extract new meaning from all this information with artificial intelligence and machine learning. As firms switch their emphasis from reducing credit risk to managing utilisation risk, growing volumes of data can incentivise and compensate for their efforts.